How Insurance Works: Premiums, Risk Pooling, and Claims (Beginner Guide)

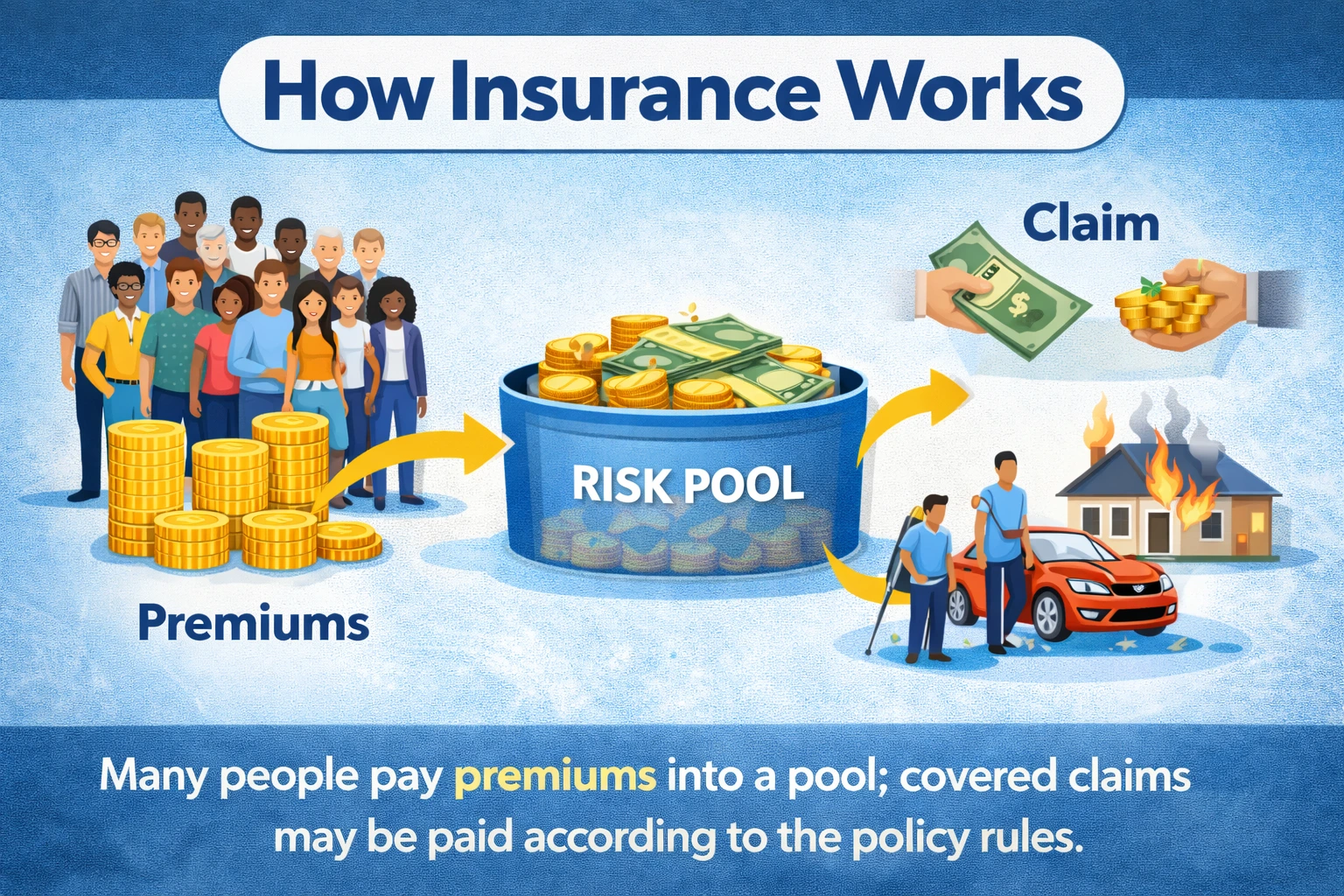

How insurance works is simple: many people pay small amounts (premiums) into a shared pool, and when a covered problem happens to someone, money from that pool may help pay—based on the policy rules.

This guide explains how insurance works in beginner-friendly language, with simple examples of premiums, risk pooling, deductibles, limits, and the claim process.

1. How Insurance Works (Simple Definition)

How insurance works in one sentence: Insurance is a contract where you pay a premium, and the insurer may help cover certain losses if specific events happen and the policy conditions are met.

Insurance is not meant to make you “profit.” It is meant to reduce the financial shock of expensive, unexpected problems—like accidents, illness, theft, or damage.

If you’re completely new, start here first:

What Is Insurance? 7 Simple Facts for Beginners.

3. Risk Pooling Explained (Easy Example)

To understand how insurance works, you must understand risk pooling.

Risk pooling means many people contribute smaller amounts, and only some people experience a loss in a given period. When a covered loss happens, the insurer may pay from that pool (based on the contract).

A simple example

Imagine 1,000 people want protection against phone theft. Each person pays a small monthly premium. In one month, maybe 10 people lose their phones. If theft is covered, the insurer can help those 10 people using part of the pooled premiums.

Want a real-life example? Auto insurance is a common place to see risk pooling in action. On our main site, you can read:

Car Insurance Premiums Worldwide: How Rates Are Calculated.

4. What Insurance Usually Pays For (And What It Won’t)

Insurance usually focuses on large, sudden costs and events that are difficult to predict perfectly.

What insurance often covers

- Sudden events: accidents, emergencies, theft, storms, unexpected damage

- Large costs: bills that would be hard to pay all at once

- Liability: costs if you are legally responsible for injury or damage to others

What insurance often does NOT cover

- Excluded events: situations the policy does not pay for

- Unlimited payments: policies have limits (maximum payouts)

- Everything you want: coverage depends on the contract

Beginner tip: Always check the policy’s coverage, exclusions, and limits before relying on it.

5. Deductibles, Limits, and Exclusions (The Rules That Matter)

Many beginners understand premiums, but get surprised by deductibles, limits, and exclusions. These are the “rules” inside the contract.

| Term | Simple meaning |

|---|---|

| Deductible | What you pay first before the insurer pays (common in auto/home). |

| Limit | The maximum the insurer will pay (per claim or per year). |

| Exclusion | A situation the policy does not cover. |

Quick deductible example

If your deductible is $500 and a covered repair costs $2,000, you pay $500 first and the insurer may pay the remaining amount—based on the policy terms.

For a simple auto insurance breakdown with coverage types, you can also read:

Affordable Auto Insurance Quotes (2025).

6. How Insurance Claims Work (Step-by-Step)

Once you understand how insurance works, the next question is: how do you use it? You use it by making a claim after a covered event happens.

- Safety first: handle urgent needs (medical help, emergency services).

- Document: take photos/videos, save receipts, write down dates and details.

- Report early: contact the insurer quickly and follow instructions.

- Submit the claim: provide forms and evidence.

- Review: the insurer checks coverage, exclusions, limits, and policy rules.

- Decision: approved, partially approved, or denied based on the contract.

- Payment: if approved, payment follows limits and deductibles.

Common reasons claims get denied: excluded event, policy not active, missing documents, late reporting, or not following claim rules.

For general consumer education, you can read:

NAIC Consumer Information

and

Insurance Information Institute.

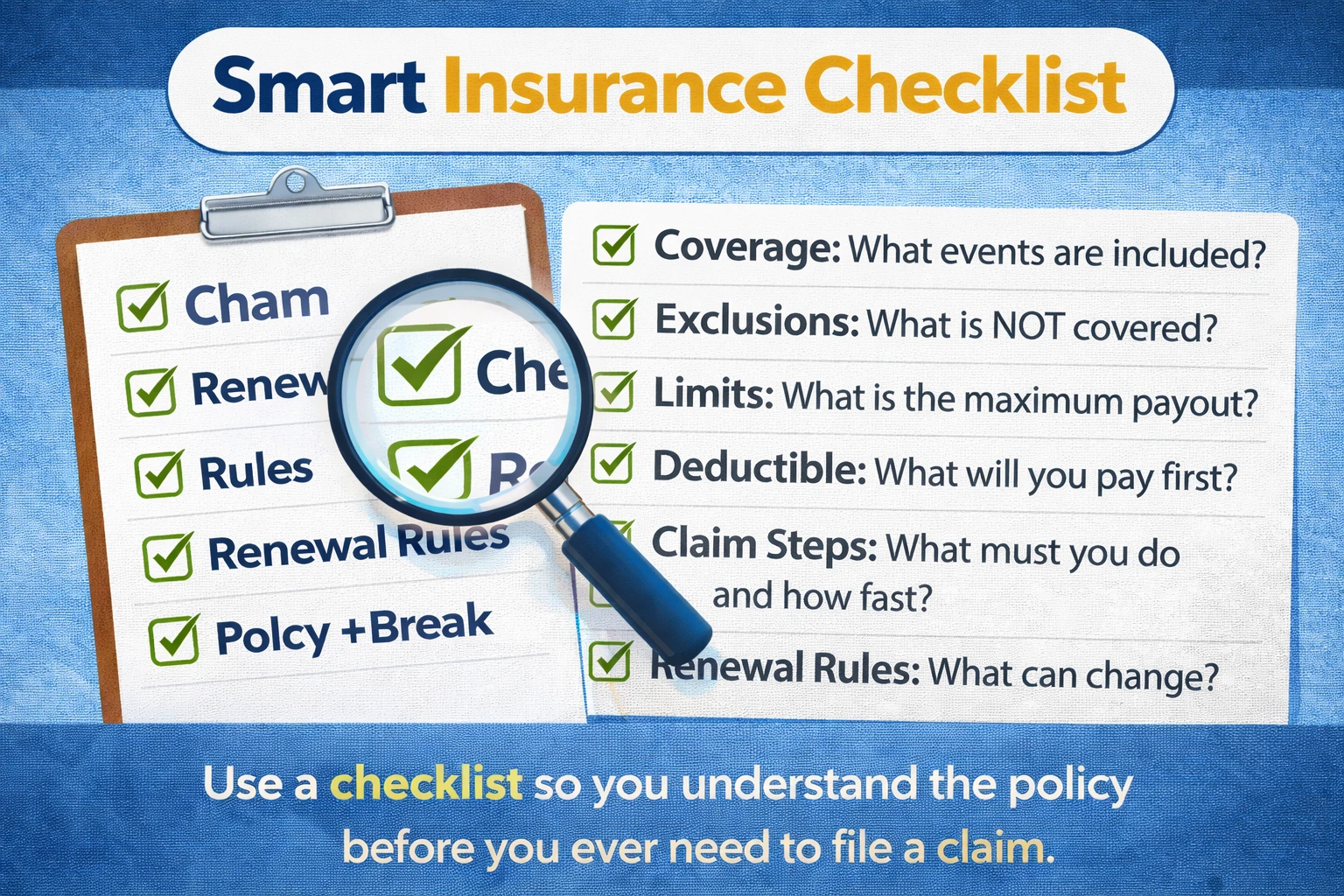

7. A Smart Checklist Before Choosing a Policy

If you’re learning how insurance works and want to avoid confusion later, use this checklist before you pay:

- Coverage: what events are included?

- Exclusions: what situations are not covered?

- Limits: what is the maximum payout?

- Deductible: what will you pay first?

- Waiting periods: when does coverage start for some benefits?

- Claim steps: what must you submit and how fast?

- Renewal rules: what can change at renewal?

Browse more beginner topics in our Insurance category and see common questions on our FAQ page.

Educational note: This article explains how insurance works for learning purposes only. It does not provide quotes, comparisons, or sales services.

FAQ

How insurance works in simple words?

How insurance works in simple words: you pay a premium, and if a covered event happens, the insurer may help pay based on the policy rules.

What is the risk pool in insurance?

The risk pool is the shared money created from many people’s premiums. It is used to pay covered claims for the people who experience losses.

Why do people pay premiums if they may never claim?

Because insurance is protection against expensive surprises. You may never claim, but the policy reduces the risk of a huge bill harming your savings.

Does insurance cover everything?

No. Policies have limits and exclusions. Always read what is covered, what is excluded, and how claims work.

What should I read first in a policy?

Start with the policy summary (declarations), then read coverage, exclusions, limits, deductible, and claim steps.