Personal Finance Basics: A 9-Step Beginner’s Roadmap to Control Your Money

Personal finance basics means learning how to plan your money so your bills are covered, your savings grows, your debt stays controlled, and your long-term goals become possible.

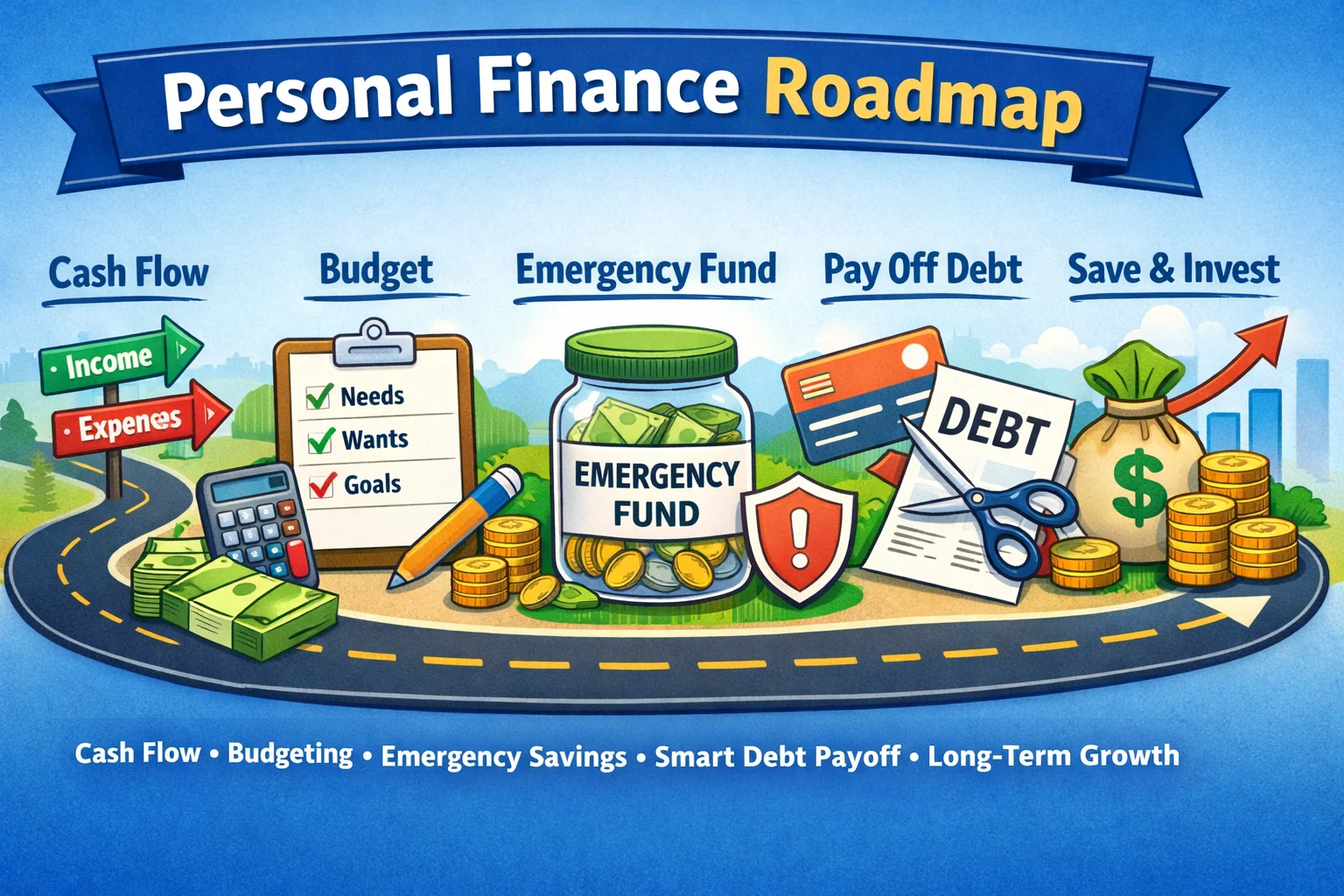

This beginner roadmap explains personal finance basics in simple steps: understand cash flow, build a budget that works, start an emergency fund, pay off high-interest debt, and begin saving and investing—without confusion.

1. Personal Finance Basics (Simple Definition)

Personal finance basics in one sentence: it’s the habit of planning and managing your money so you can live today and still build a better tomorrow.

Many beginners feel stressed about money because they don’t know where it goes. When money leaves faster than it comes in, you feel stuck—even if you work hard. And when an emergency happens (illness, repairs, job problems), it can wipe out months of progress.

The good news: personal finance basics is not about being rich. It’s about building control and consistency. Small improvements (tracking spending, budgeting, saving weekly) can change everything over time.

2. Set Clear Money Goals (So Your Plan Has Direction)

Without goals, budgeting feels like punishment. With goals, budgeting becomes a tool. A simple goal tells your brain why you are saying “no” to some spending today.

Personal finance basics goals (3 levels)

- Short-term (0–3 months): Stop running out of money before payday.

- Medium-term (3–24 months): Build an emergency fund and clear expensive debt.

- Long-term (2+ years): Invest and build wealth for bigger goals (education, business, home, retirement).

Beginner tip: Make goals simple and measurable: “Save ₦50,000 by February 28” is clearer than “save more money.” The clearer the goal, the easier it is to stay consistent.

3. Know Your Cash Flow (Income vs Expenses)

Cash flow is the foundation of personal finance basics. If you don’t know the difference between what comes in and what goes out, it’s impossible to plan.

Do this in 15 minutes

- Write monthly income: salary, business, side work, support (use a realistic average).

- Write fixed expenses: rent, transport, data, subscriptions, school fees, minimum debt payments.

- Estimate variable expenses: food, fuel, electricity, gifts, eating out, random spending.

- Calculate: income − expenses = leftover (or shortage).

If the result is negative, your first goal is not investing. Your first goal is stopping the leak. That is still progress in personal finance basics.

| If your cash flow is… | Your best next step |

|---|---|

| Negative (expenses > income) | Cut costs, increase income, and renegotiate bills/debt. |

| Small positive | Start a small emergency fund and attack high-interest debt. |

| Strong positive | Invest consistently and protect your plan. |

4. Build a Beginner Budget You Can Follow

A budget is simply a plan for your money—made before you spend it. In personal finance basics, budgeting is the bridge between your income and your goals.

A simple “3-bucket” budget

- Needs: rent, food, transport, basic bills

- Goals: savings, emergency fund, debt payoff, investing

- Wants: lifestyle spending (entertainment, eating out, upgrades)

If you need a quick formula, you can start with a 50/30/20 approach (then adjust to your reality): 50% needs, 30% wants, 20% goals. If 20% is too hard, start with 5% and increase gradually. Personal finance basics works best when it is sustainable.

Helpful resource:

CFPB budgeting tools (free)

Beginner rule: Budget weekly, not only monthly. A weekly check (10–15 minutes) helps you notice problems early.

5. Start an Emergency Fund (Your Safety Net)

An emergency fund is money saved for real emergencies: job loss, urgent medical costs, essential repairs, or unexpected bills. This is one of the most important parts of personal finance basics, because emergencies are what destroy budgets.

How much should you save?

- Starter fund: one week of essential expenses (small target is okay).

- Next level: one month of essential expenses.

- Strong safety net: 3–6 months of essential expenses (more if your income is unstable).

Where should you keep it? Somewhere safe and easy to access. The emergency fund’s job is stability, not big returns.

Simple habit: automate a small weekly transfer into savings. Even tiny amounts build momentum in personal finance basics.

6. Pay Off Debt Smarter (Avalanche vs Snowball)

Debt is not always “bad,” but high-interest debt is expensive. It takes money you could use for saving, investing, and your goals. In personal finance basics, high-interest debt is often the biggest obstacle to progress.

Two simple payoff methods

- Debt Avalanche: focus extra money on the highest interest rate first (often saves the most money).

- Debt Snowball: focus extra money on the smallest balance first (often feels more motivating).

Both methods work. Pick the one you can stick with. The best strategy in personal finance basics is the one you do consistently.

Quick example

Keep paying minimum payments on all debts. Then send any extra money to your target debt (avalanche or snowball) until it is cleared. After that, move to the next one.

Beginner warning: Avoid new “easy payments” or “buy now, pay later” if you already have cash flow problems. It can quietly increase your monthly pressure.

7. Saving vs Investing (What to Do First)

Saving and investing are both important, but they have different jobs. Understanding this is key in personal finance basics.

| Saving | Investing |

|---|---|

| Best for emergencies and short-term goals | Best for long-term goals (years) |

| Lower risk, lower return | Higher risk, higher potential return |

| You may need it soon | You can leave it to grow |

Beginner priority order

- Cover basic needs

- Build a starter emergency fund

- Reduce high-interest debt

- Save and invest consistently for long-term goals

Simple rule: Don’t invest money you’ll need next month. That is savings money.

Learn investing basics:

Investor.gov: Introduction to investing

8. Protect Your Plan (Risk + Insurance Basics)

Many people build savings… then one accident or emergency resets everything. Protecting your plan is part of personal finance basics because it keeps your progress stable.

Personal finance basics protection checklist

- Reduce risk: avoid scams, avoid unnecessary debt, be careful with big purchases.

- Build buffers: emergency fund, stable budget, and a simple plan for surprises.

- Understand protection: know how premiums, deductibles, limits, and claims work.

If you’re new to protection and risk, these internal beginner guides will help:

- What Is Insurance? 7 Simple Facts for Beginners

- How Insurance Works: Premiums, Risk Pooling & Claims (Beginner Guide)

Simple idea: A plan is not only “how to grow money.” A plan is also “how to stop one surprise from destroying your money.”

9. A Simple 30-Day Roadmap (Beginner Plan)

If you want a clear start, follow this 30-day roadmap. This is personal finance basics done in a simple and repeatable way.

Week 1: Get clarity

- Track every expense for 7 days (notes app is fine).

- Write your 3 money goals (short, medium, long).

- List all debts and monthly bills.

Week 2: Build your budget

- Create your 3-bucket budget (needs, goals, wants).

- Set a weekly spending limit for variable spending.

- Cut one cost immediately (subscription, impulse buys, frequent eating out).

Week 3: Build your safety net

- Start a starter emergency fund (small target is okay).

- Automate a weekly savings transfer if possible.

- Choose a debt payoff method (avalanche or snowball).

Week 4: Make it sustainable

- Pick a weekly “money review day” (15 minutes).

- Plan the next month before it begins.

- Increase your “goals” bucket slightly (+1% is still progress).

Key idea: Your plan should be boring. Boring plans are stable plans. This is how personal finance basics becomes real life.

FAQ

What are personal finance basics?

Personal finance basics are the core money habits: tracking spending, budgeting, saving, paying down debt, and investing for long-term goals.

How do I start personal finance with a low income?

Start with cash flow and a simple budget, cut one cost, build a small emergency fund, and focus on high-interest debt. Consistency matters more than big numbers.

Should I save or pay debt first?

Many beginners do both: build a small starter emergency fund first, then focus strongly on high-interest debt while saving a little on the side.

How much should I save each month?

A common target is 10%–20%, but if that feels too hard, start with 2%–5% and increase gradually. That is still personal finance basics done correctly.

What is the easiest budget for beginners?

The easiest beginner budget is the 3-bucket budget: needs, goals, and wants. It’s simple, flexible, and easy to maintain.