Financial Literacy Skills Everyone Should Learn in 2025 (Simple, Practical Guide)

Financial literacy skills are the everyday money abilities that help you manage your income, plan spending, build savings, control debt, understand basic investing, and protect yourself from expensive surprises.

This beginner-friendly guide explains the most important financial literacy skills, why they matter in real life, and how to learn them step by step—using simple habits you can repeat every week.

1. What Are Financial Literacy Skills? (Simple Definition)

Financial literacy skills in one sentence: they are the practical skills that help you understand money and use it wisely—so you can handle today’s needs and still build a better future.

These skills are not about “getting rich quick.” They are about everyday control and fewer money surprises. With strong money skills, you can answer questions like:

- Where does my money go each month?

- How can I budget without feeling trapped?

- How do I save when income is small?

- How do interest and fees affect my debt?

- How do I start investing safely (long-term thinking)?

- How do I protect myself from emergencies?

If you want a simple starting roadmap, read:

Personal Finance Basics: A Beginner’s Roadmap.

2. Why These Skills Matter in 2025 (Real-Life Reasons)

In 2025, money decisions are everywhere: subscriptions, digital payments, credit offers, online shopping, and financial “advice” on social media. Without strong financial literacy skills, it’s easy to overspend, borrow under pressure, or fall into scams.

These skills help you:

- Reduce money stress: you know what you have and what you can afford.

- Avoid debt traps: you understand interest, fees, and minimum payments.

- Build real savings: even small savings protects you from emergencies.

- Make smarter decisions: you compare options and read terms before committing.

- Protect your progress: one unexpected expense won’t destroy your plan.

- Grow over time: consistent habits compound into stability and wealth.

Simple truth: You don’t need a high income to use money wisely. But without money skills, even a high income can disappear quickly.

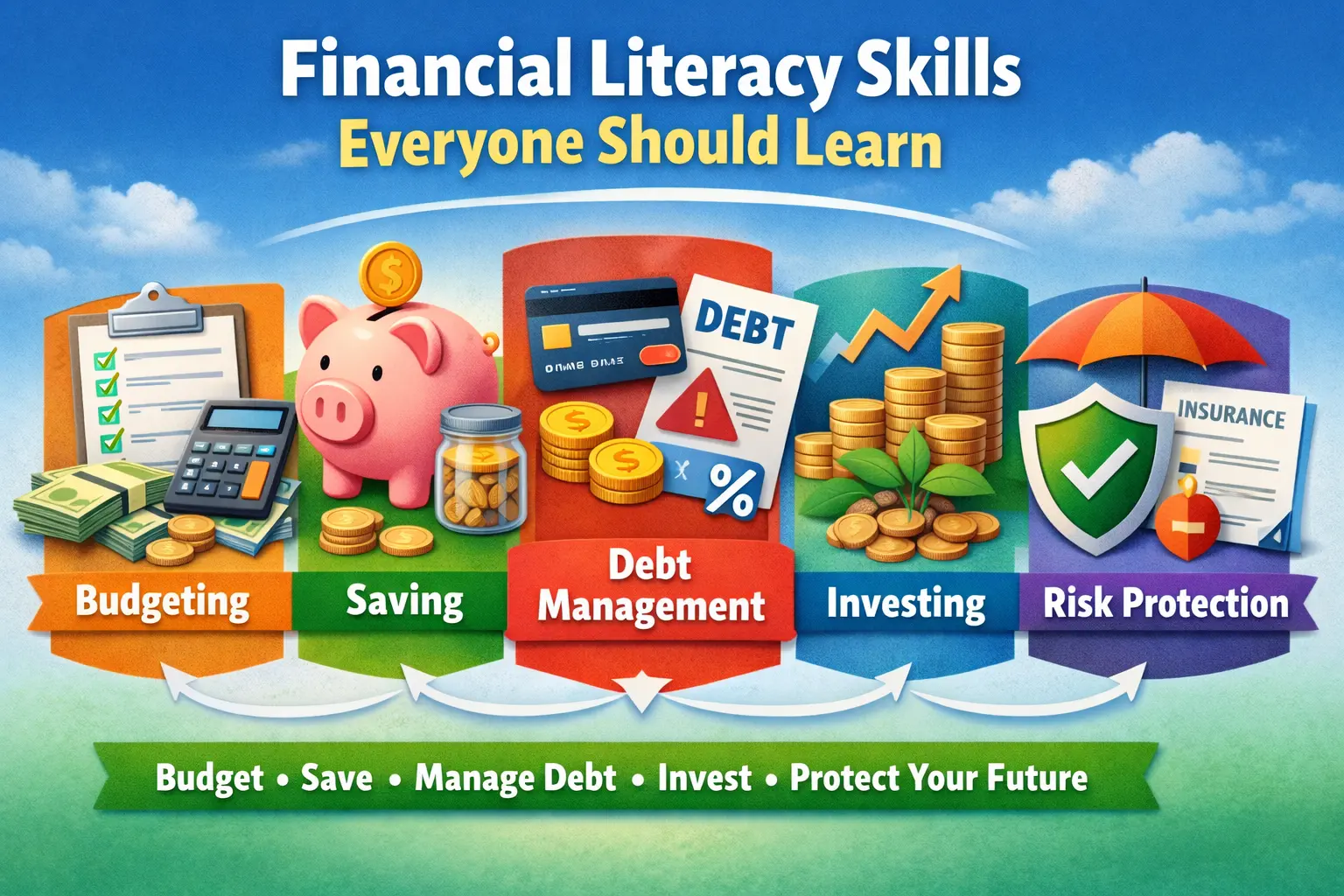

3. The 6 Core Financial Literacy Skills

Most “money success” comes from mastering a few basics and repeating them consistently. These are the six skills that matter most.

1) Cash flow (income vs expenses)

Cash flow means knowing what comes in and what goes out. If you don’t track spending, your decisions become guesses. A simple weekly review of expenses can reveal where your money leaks.

2) Budgeting (a plan before spending)

A budget is not punishment. It’s a plan for your money before you spend it. A good budget is simple and realistic, not perfect. Many beginners do well with “Needs, Goals, Wants.”

3) Saving (especially an emergency fund)

Savings is what stops emergencies from turning into debt. Your emergency fund is a buffer for job changes, medical costs, urgent repairs, or unexpected bills. Start small, then build steadily.

4) Debt and credit (interest, fees, and terms)

Debt becomes dangerous when interest is high or payments are unclear. Financial literacy means understanding what you owe, the interest rate, the total cost, and how long repayment will realistically take.

5) Investing and long-term planning (risk + time)

Investing is long-term. Financial literacy helps you understand that risk and time go together, and that “fast profit” promises often come with high risk or scams. The goal is steady growth over years, not quick wins.

6) Protection (risk management)

One accident can wipe out savings. Protection includes an emergency fund, safe habits, and (when relevant) insurance coverage for major risks. Understanding protection is part of strong financial literacy.

For a simple protection explanation, read:

How Insurance Works: Premiums, Risk Pooling & Claims.

4. Signs You Should Strengthen Your Money Skills

Most people weren’t taught money basics in school. If any of these feel familiar, improving financial literacy skills will help.

- You don’t know your true monthly spending (you only guess).

- You often run out of money before payday.

- You use loans or credit to cover basic needs repeatedly.

- You have no emergency savings at all.

- You buy quickly and regret purchases later.

- You feel confused by terms like APR, fees, or compound interest.

- You are tempted by “get rich” offers without checking risk.

Good news: these are learnable skills. You can improve with practice, not talent.

5. How to Learn Financial Literacy Skills (Simple Steps)

Build these skills in small steps. The goal is progress you can repeat—not a “perfect month” that collapses later.

Step 1: Track spending for 7 days

Write every expense for one week. Even small purchases matter. This gives you the truth about your habits.

Step 2: Make a simple budget

Use “Needs, Goals, Wants.” Allocate to essentials first, then choose a realistic amount for savings/debt, and leave a small amount for wants so the budget is sustainable.

Step 3: Start a starter emergency fund

Start with a small target (for example: one week of essential expenses). Then build toward one month, then 3–6 months if possible.

Step 4: Reduce high-interest debt

Pay minimums on all debts, then focus extra money on one target debt (highest interest or smallest balance—choose what you can stick with).

Step 5: Learn one topic per week

One topic per week is enough: budgeting, saving, debt, investing basics, protection basics. Slow learning is sustainable learning.

Helpful budgeting resource:

CFPB budgeting tools (free).

6. Weekly Habits That Build Money Skills Fast

Habits beat motivation. A small routine can build strong financial literacy skills in a few months.

Try this weekly routine (15 minutes)

- Check balances: know what you have today.

- Review spending: where did money go this week?

- Adjust the plan: set a simple spending limit for the next week.

- Save something: even a small amount builds consistency.

- Learn one concept: interest, fees, budgeting, investing basics, or risk protection.

Tip: Keep it boring. Boring routines are stable routines.

7. Common Mistakes (And Easy Fixes)

Mistake 1: Tracking nothing (then guessing)

Fix: Track spending for 7 days. After that, track weekly totals by category (food, transport, bills, etc.).

Mistake 2: Making a budget that is too strict

Fix: Leave room for real life. A budget should be flexible. If it feels like punishment, it won’t last.

Mistake 3: Saving “only when there’s extra”

Fix: Save first (even small). Treat savings like a bill you pay yourself.

Mistake 4: Ignoring high-interest debt

Fix: Identify your highest-interest debt and make it a priority. High interest quietly steals future income.

Mistake 5: Jumping into risky investments too early

Fix: Build a starter emergency fund first, learn basics, and avoid “guaranteed” fast returns.

Mistake 6: Forgetting protection

Fix: Plan for emergencies (emergency fund) and understand basic risk tools (like insurance) so one event doesn’t reset your progress.

8. Trusted Resources

Reminder: A major financial literacy skill is learning how to verify sources—especially online.

FAQ

What are financial literacy skills in simple words?

Financial literacy skills are the everyday skills that help you manage money: track spending, budget, save, handle debt, understand investing basics, and protect yourself from surprises.

Why should everyone learn financial literacy skills?

Because they reduce money stress, prevent costly mistakes, help you build savings, and support long-term stability—no matter your income level.

How can I start learning fast?

Track spending for a week, make a simple budget, start small savings, reduce high-interest debt, and learn one money topic per week.

Are financial literacy skills only for rich people?

No. These skills help anyone manage any income better and avoid common money problems.