Policy Limit Explained: Avoid Costly Surprises + 9 Simple Examples

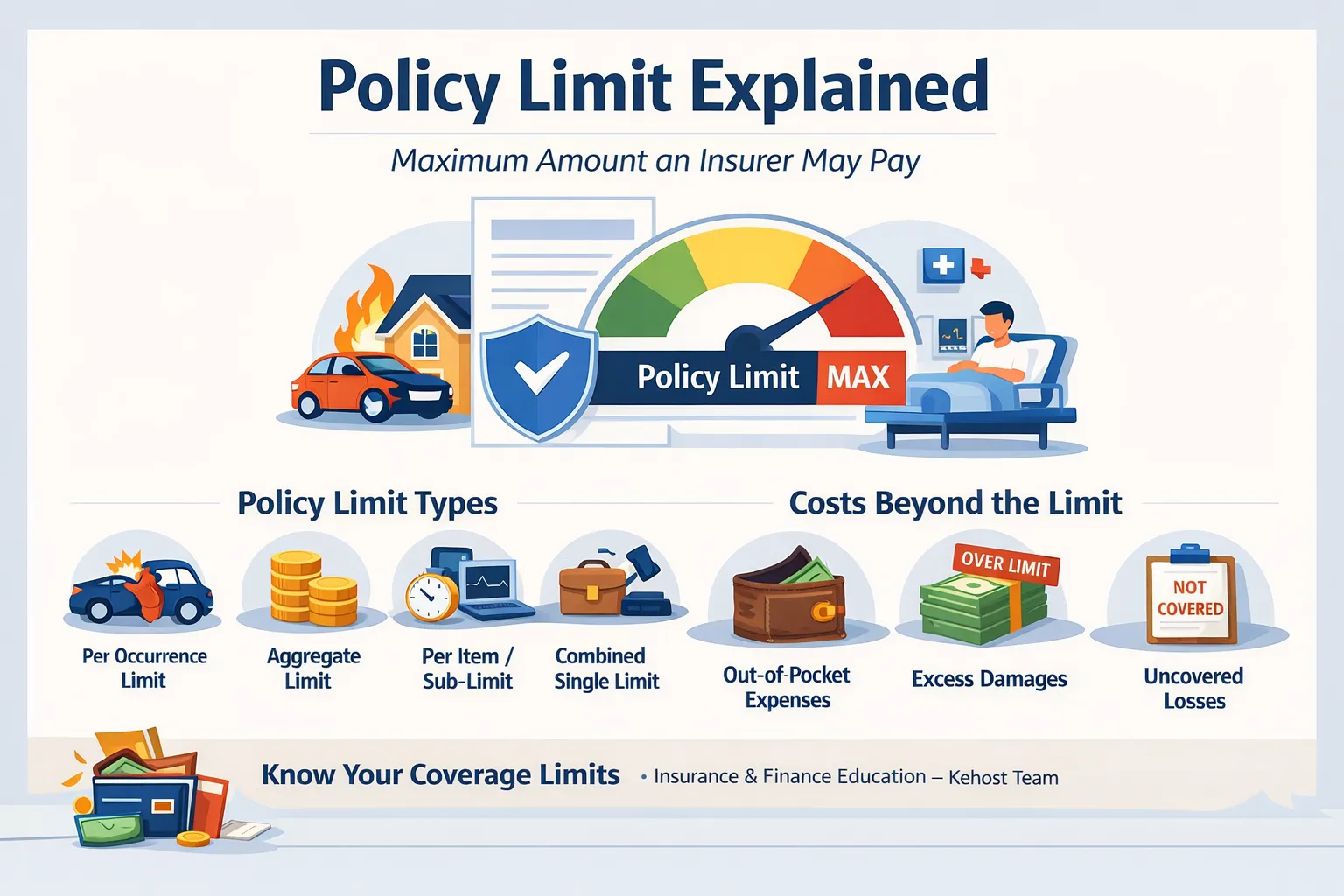

Policy limit is one of the most important insurance terms to understand because it sets the maximum amount an insurance policy may pay for a covered loss. Many beginners focus on the premium only, but real protection depends on the policy’s limits, deductibles, exclusions, and the type of claim.

In this beginner-friendly guide from Insurance & Finance Education (operated by Kehost Team), you’ll learn what a policy limit means, why it matters, how it affects insurance cost, and how to avoid common “I thought I was covered” surprises—without sales language, quotes, or brand recommendations.

A simple introduction explaining the topic in plain language

Insurance helps reduce financial shock. Instead of paying the full cost of a major loss alone, you pay a predictable amount (your premium) to keep coverage active. If a covered event happens, the insurer may contribute to the cost—based on the policy rules.

But insurance is not unlimited. Most policies include a maximum payout. That maximum is the policy limit (often called coverage limits). If a loss is larger than the limit, the amount above the limit may remain your responsibility.

If you want the basics of the main terms first, read this internal guide:

Key Insurance Terms Explained (Premium, Deductible, Limit, Exclusion).

Key factors that influence insurance costs (age, risk, location, coverage, deductibles, etc.)

Pricing factors vary by product and country, but insurers worldwide often evaluate similar categories. These inputs shape your risk profile (likelihood of a claim) and expected claim size (severity).

1) Risk profile factors

- Age and experience: can influence expected claims in some insurance types.

- History (where relevant): prior incidents/claims can signal future risk.

- Usage patterns: how often an activity happens (driving frequency, travel patterns, business exposure).

- Health or lifestyle factors: used in certain products (rules differ across countries).

2) Location and environment

- Local hazards: theft, accident rates, storms, floods, wildfire exposure.

- Cost levels: repair prices, medical costs, labor costs, and service availability.

- Legal/claims environment: dispute costs and liability patterns differ by region.

3) Coverage design choices

- Coverage limits: higher limits typically increase premium.

- Deductible impact: higher deductibles often reduce premium, but raise your out-of-pocket risk.

- Exclusions and sub-limits: more restrictions may reduce premium but reduce protection.

- Coverage breadth: broader coverage generally costs more than narrow coverage.

Key idea: your premium is usually a blend of risk profile + coverage structure. The policy limit is a major structural driver because it changes the insurer’s maximum potential payout.

Why insurance premiums vary from person to person

Insurance premiums vary because people are not identical in risk, exposure, location hazards, or coverage choices. Even when two people buy “the same type” of insurance, they might not have the same:

- policy limit (maximum payout)

- deductible level

- sub-limits for specific categories

- exclusions and conditions

- asset value or local costs

This is why comparing insurance cost fairly means comparing the full structure—not just the monthly price.

Related internal guide on risk:

What Is Risk? Simple Meaning + Real Examples.

General cost ranges explained carefully (avoid exact prices)

People often ask for the “average cost (general)” of insurance. The most accurate answer—especially for a global audience—is that it varies widely and depends on multiple factors.

Instead of focusing on exact numbers (which can mislead across countries), think in patterns:

- Often lower-cost situations: lower-risk profile signals, higher deductibles, lower coverage limits, narrower coverage.

- Often higher-cost situations: higher hazard exposure, lower deductibles, higher policy limits, broader coverage, higher local repair/medical costs.

Because the policy limit changes maximum insurer payout, it can shift the premium meaningfully—sometimes more than people expect.

How deductibles, limits, and coverage choices affect total cost

A calm way to understand insurance cost is to separate two parts:

- Premium: what you pay regularly to keep coverage active.

- Out-of-pocket costs: what you may pay when a loss happens (deductible + any amount above limits + anything excluded).

Deductible impact (what you pay first)

A deductible is the amount you pay out of pocket before the insurer contributes in parts of coverage where deductibles apply. A higher deductible often lowers the premium because you carry more of the first loss.

Policy limit impact (maximum payout)

The policy limit is the maximum the insurer may pay for covered losses within a category and time period. Higher limits usually increase premium because the insurer could pay more in severe scenarios. Lower limits may reduce premium, but they increase the chance you face large uncovered costs.

Coverage choices, exclusions, and sub-limits

Coverage choices decide what risks are included. Exclusions remove certain situations from coverage, and sub-limits cap specific categories (for example, electronics, jewelry, certain services, or certain types of liability). Many “surprises” happen when people ignore these details and assume coverage is unlimited.

Practical takeaway: a “cheap premium” can hide a high deductible or low coverage limits. Total cost is what you pay regularly + what you might still pay during a loss.

For cost-sharing terms, see:

Deductible vs Copay vs Coinsurance: Clear Difference + Examples.

9 simple examples showing why policy limits matter

Note: These are educational examples only (not prices, not advice, and not country-specific). They show how a policy limit can change what happens after a claim.

Example 1: Auto liability claim exceeds the policy limit

A covered liability claim can be expensive. If the total loss is above your policy limit, the insurer may pay up to the limit and the remaining amount may become your responsibility (depending on local rules).

Example 2: Home contents “overall limit” vs electronics sub-limit

Your overall contents limit may look high, but electronics might have a smaller sub-limit. If your electronics loss is above that cap, you may not receive full reimbursement.

Example 3: Travel medical emergency in a high-cost setting

A travel policy may cover emergency care but only up to a defined policy limit. If medical costs are very high, the limit can decide how much financial shock is actually reduced.

Example 4: Per-occurrence limit vs aggregate limit

A policy can pay up to a per-occurrence limit for one incident, but an aggregate limit can cap total payments across many claims during the year.

Example 5: Small claims add up and exhaust an annual cap

Even if each claim is covered, repeated claims in one category can reach an annual aggregate limit. After that, the policy may not pay further covered amounts for that category.

Example 6: High deductible + low limit creates a “coverage gap”

If your deductible is high and your policy limit is low, you may still pay a large share of a serious loss yourself—even though the event is “covered.”

Example 7: Limit applies per item, not per event

Some policies cap payment per item (phone, laptop, bicycle). A major loss involving multiple items can still be restricted by item limits.

Example 8: A claim is partly covered but specific costs are excluded

Even with a high limit, exclusions can remove certain costs from coverage. That’s why limit + exclusions must be read together.

Example 9: Limit helps you plan realistically (not emotionally)

Knowing your policy limit helps you plan your savings and risk management: you can see what the policy can absorb and what you still need to handle.

If you want a neutral glossary reference, you can also review general insurance terms here:

Insurance Terms and Definitions (PDF).

And for a general explanation of deductibles in health-related coverage:

Health Insurance Deductible Explained.

Common misconceptions people have about insurance pricing

Misconception 1: “If it’s covered, the insurer pays everything.”

Coverage usually comes with deductibles, policy limits, exclusions, and conditions. “Covered” does not always mean “fully paid.”

Misconception 2: “Lowest premium is always best.”

A lower premium may come with higher deductibles, lower coverage limits, and stricter exclusions—raising your real out-of-pocket risk.

Misconception 3: “My premium should match my friend’s.”

Different risk profiles, locations, asset values, and policy structures can create different premiums—even for similar insurance types.

Misconception 4: “Average cost predicts my premium.”

Average cost varies widely. Your premium depends on multiple pricing factors and your coverage choices.

Misconception 5: “Policy limit only matters in rare disasters.”

Limits matter most in severe events, but severe events do happen. Limits are one reason insurance remains financially manageable instead of unlimited.

Practical, non-sales tips for managing or reducing insurance costs safely

1) Compare policies “like for like”

Match the policy limit, deductible level, and major exclusions when comparing insurance cost. Otherwise, you may compare different protection levels.

2) Choose a policy limit based on realistic worst-case scenarios

Think calmly about what a serious loss could cost in your situation. The goal is not perfection—it’s avoiding extreme exposure you could not handle.

3) Use deductible impact thoughtfully

A higher deductible can reduce premium, but only choose it if you could pay it without financial stress during a difficult moment.

4) Look for sub-limits and exclusions (the hidden “caps”)

Many claim surprises happen because of sub-limits (smaller caps inside the policy) or exclusions (things not covered). These details can matter more than small premium differences.

5) Reduce avoidable risk

Safe habits, maintenance, secure storage, and prevention can reduce losses over time. That can protect your finances regardless of premium level.

6) Keep an emergency buffer

Even modest savings can help with deductibles and costs above limits. It also reduces the chance of using high-cost debt after a loss.

A short educational disclaimer stating the content is for learning only and not insurance advice

Educational disclaimer: This article is for general education only and is not insurance, legal, medical, or financial advice. Policy limits, deductibles, exclusions, pricing factors, and claims rules vary by country, insurer, and product type. Always read your policy documents for your exact terms.

Conclusion

A policy limit matters because it defines the maximum the insurer may pay for covered losses. Premiums exist to fund risk pooling, and they vary because risk profile, location, and coverage choices change expected claim costs. When you understand coverage limits—along with deductible impact, exclusions, and policy structure—you can interpret insurance cost more realistically and avoid false confidence based on price alone.

The goal is not to overthink insurance. It’s simply to understand the boundaries: what the policy may pay, what you may still pay, and how your choices shape both premium and protection.