What Is Insurance? 7 Simple Facts for Beginners

What is insurance? Insurance is a simple agreement that helps you handle big, unexpected costs. You pay a small amount regularly (called a premium), and if a covered problem happens—like an accident, illness, fire, theft, or damage—the insurance company may help pay according to the policy rules.

This guide explains what is insurance in beginner-friendly language, using simple examples and clear definitions.

1. What Is Insurance?

What is insurance in one sentence? Insurance is a contract where you pay a premium, and the insurer agrees to help cover certain losses if specific events happen.

The goal is not to make you “profit.” The goal is to reduce the financial shock of expensive problems. If the loss is covered, insurance can help you recover faster and protect your savings.

2. Why Insurance Exists

Life comes with risks. Some risks are small (like a minor repair), while others can be huge (like a hospital bill, major accident, or house fire). Insurance exists because most people cannot comfortably pay for large losses at any time.

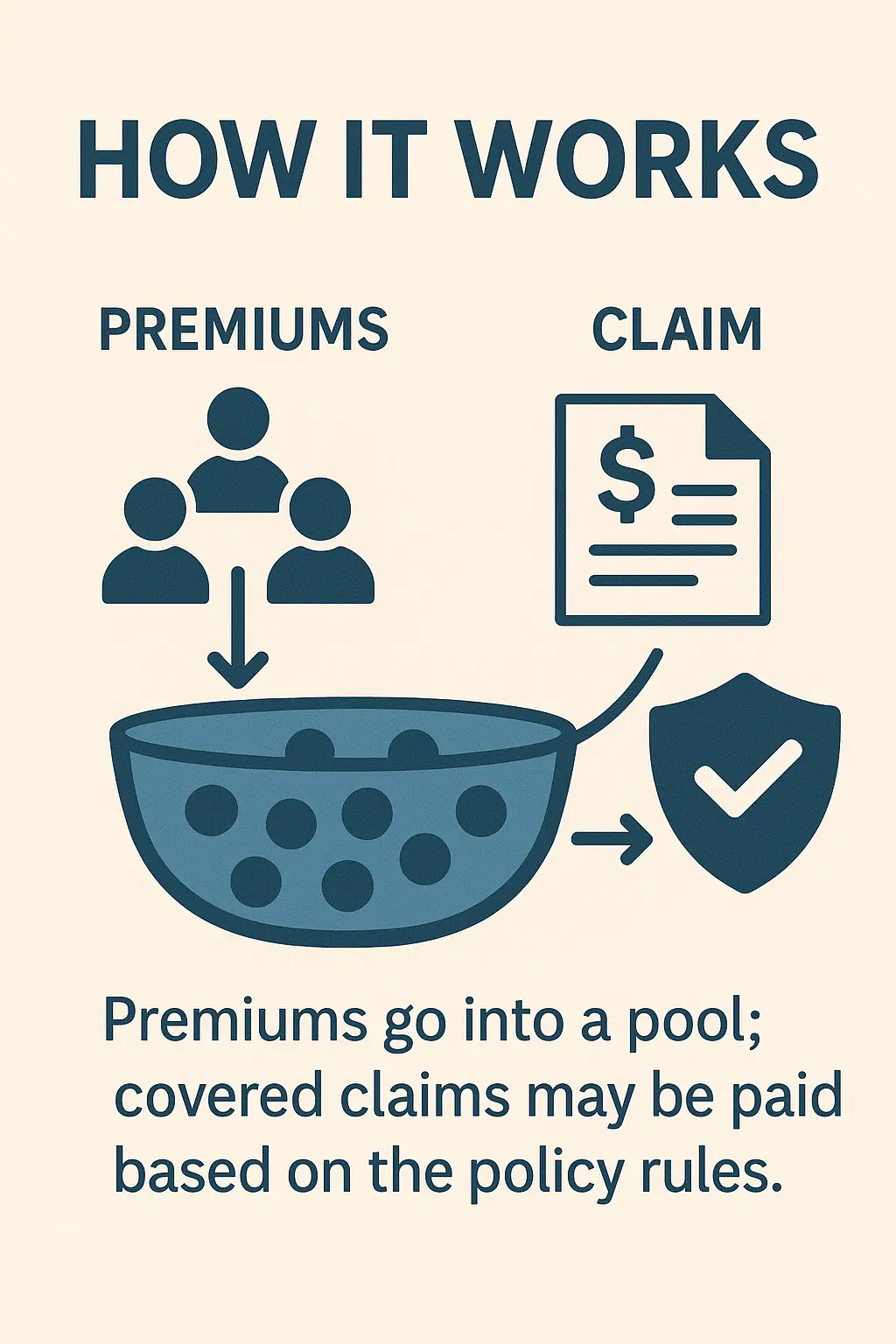

What is insurance really doing? It helps you plan for uncertainty. Instead of one person paying a massive bill alone, many people contribute smaller amounts, and the insurer pays covered claims from that pool of money.

- Protects savings: reduces the chance of losing years of savings in one event.

- Creates stability: helps families and businesses recover after shocks.

- Supports responsibility: liability coverage can protect you if you damage someone else’s property or cause injury.

3. How Insurance Works

To understand what is insurance, you need to understand one big idea: risk sharing. Many people pay premiums into a shared pool. Only some people will face a loss in a given period. When a covered loss happens, money from that pool is used to help pay.

A simple example

Imagine 1,000 people want protection against phone theft. Each person pays a small monthly premium. In a month, maybe 10 people lose their phones. If the policy covers theft, the insurer can help those 10 people, using part of the premiums collected from the group.

What insurance usually covers

- Sudden events: accidents, unexpected damage, theft, emergencies

- Large costs: bills that would be difficult to pay at once

- Liability: costs if you are legally responsible for harm to others

What insurance does not cover

Insurance does not cover everything. Policies include:

- Exclusions: situations the policy does not pay for

- Limits: the maximum amount the insurer will pay

- Rules: steps you must follow when reporting and claiming

4. Key Insurance Terms Beginners Should Know

When people ask what is insurance, they often get confused by new words. These are the most important terms you will see in many policies:

| Term | Simple meaning |

|---|---|

| Premium | The amount you pay to keep the policy active (monthly or yearly). |

| Policy | The insurance contract—rules, benefits, exclusions, and limits. |

| Coverage | What the insurer may pay for when a covered event happens. |

| Deductible | What you pay first before the insurer pays (common in auto/home). |

| Limit | The maximum the insurer will pay (per claim or per year). |

| Exclusion | A situation the policy does not cover. |

| Claim | A request for the insurer to pay after a covered loss. |

Beginner tip: If you understand premiums, deductibles, limits, and exclusions, you already understand most of what is insurance.

5. Common Types of Insurance

What is insurance used for in daily life? Different types of insurance exist for different risks. Here are common examples:

Health insurance

Often helps reduce the cost of medical care, such as hospital visits, treatment, tests, and emergencies—depending on your policy.

Life insurance

Provides financial support to your beneficiaries if you die. It can help replace income or support family responsibilities.

Auto (car) insurance

Often includes liability coverage (damage/injury you cause to others). Some policies also cover damage to your car.

Homeowners or renters insurance

Home insurance may cover property damage and belongings from certain events. Renters insurance often covers personal property and liability for renters.

Business insurance

Helps businesses manage risks like liability, property damage, and operational disruption—depending on the policy type.

For more beginner guides, browse our Insurance category, and see common questions on our FAQ page.

6. How Insurance Claims Work

Once you know what is insurance, the next question is: how do you use it? You use it by making a claim after a covered event.

- Stay safe first: handle urgent safety needs (medical help, emergency services).

- Document: photos, receipts, dates, and details.

- Report early: contact the insurer quickly and follow their instructions.

- Submit the claim: provide forms and evidence.

- Review: the insurer checks coverage, limits, exclusions, and policy rules.

- Decision: approved, partially approved, or denied based on the contract.

- Payment: if approved, payment is made according to limits and deductibles.

Why claims get denied: common reasons include excluded events, missing documents, late reporting, or the policy not being active. This is why understanding what is insurance includes understanding the policy rules.

For general consumer education, you can read trusted resources like:

NAIC Consumer Information

and

Insurance Information Institute.

7. A Smart Checklist Before Choosing a Policy

If you’re learning what is insurance and want to avoid confusion later, use this checklist before you rely on any policy:

- Coverage: what events are included?

- Exclusions: what situations are not covered?

- Limits: what is the maximum payout?

- Deductible: what will you pay first?

- Waiting periods: when does coverage start for certain benefits?

- Claim steps: what must you submit and how fast?

- Renewal rules: what can change when the policy renews?

Educational note: This article explains what is insurance for learning purposes only. It does not provide quotes, comparisons, or sales services.

FAQ

What is insurance in simple words?

What is insurance in simple words? It is a plan where you pay a small amount regularly, and the insurer may help pay for certain big losses if they happen.

Is insurance the same as saving money?

No. Savings are your own money you keep. Insurance is risk sharing—many people pay premiums so covered losses can be paid when they occur.

Why do people pay insurance premiums?

People pay premiums to reduce the financial shock of unexpected events. The premium keeps the policy active, so you can claim if something covered happens.

Does insurance cover everything?

No. Every policy has limits and exclusions. Always read what is covered, what is excluded, and how claims work.

What should I read first in a policy?

Start with the policy summary/declarations, then read coverage, exclusions, limits, deductible, and claim steps. That is the fastest way to understand what is insurance in your specific policy.