Car Insurance Premiums: 9 Smart Reasons Costs Differ by Driver

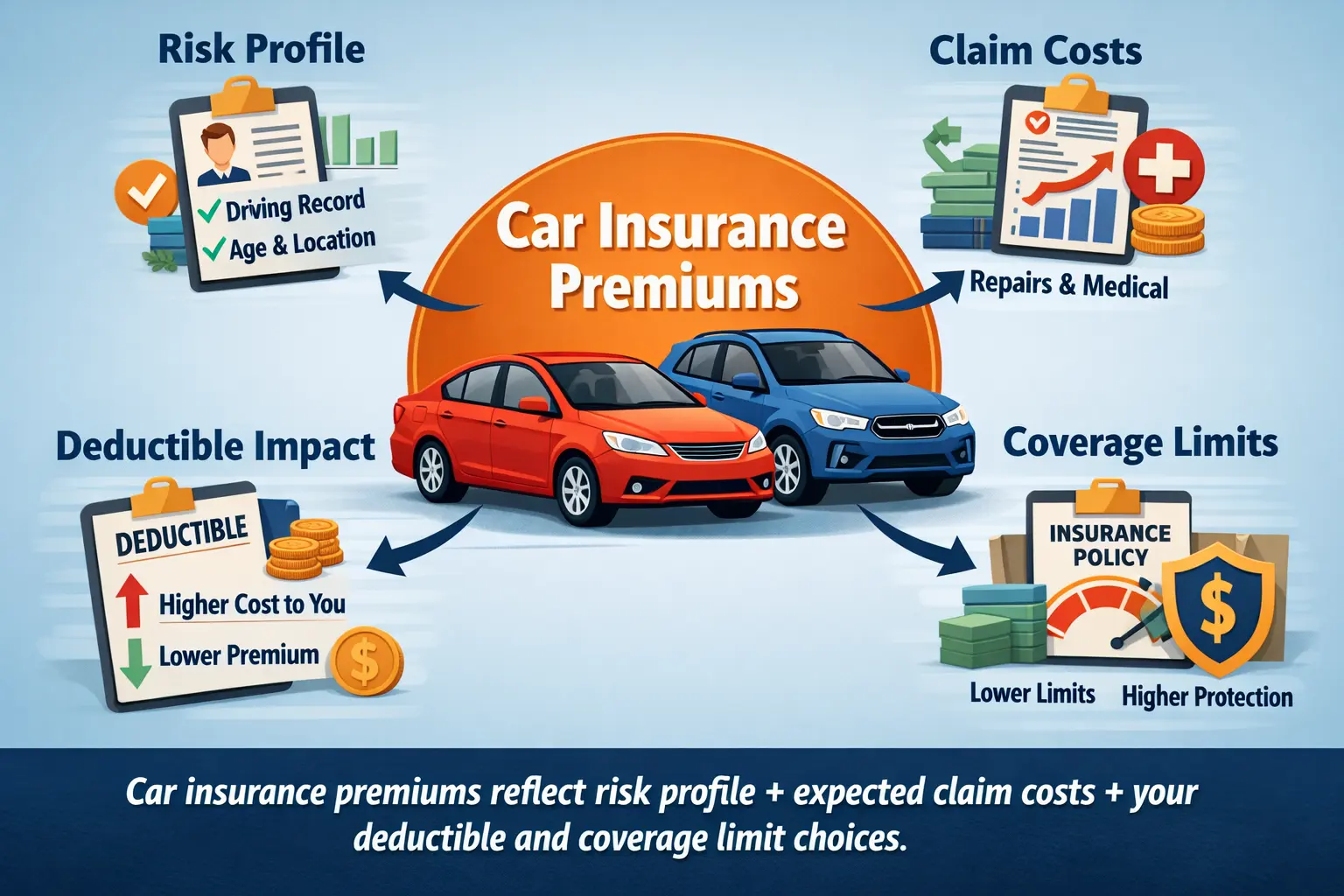

Car insurance premiums can be confusing because two people with similar cars may pay very different amounts. That difference usually isn’t random. It comes from how insurers estimate risk, the expected cost of claims, and the coverage choices each driver makes.

This beginner-friendly guide from Insurance & Finance Education (operated by Kehost Team) explains what an insurance premium is, the most common pricing factors, why insurance cost varies from person to person, and how deductible impact and coverage limits shape total cost—without selling, quotes, or brand recommendations.

1. A Simple Introduction Explaining the Topic in Plain Language

Car insurance exists to reduce the financial shock of expensive events—like crashes, injuries, theft, or major vehicle damage. You pay a regular amount (your premium), and if a covered event happens, the insurer may help pay certain costs based on the policy rules.

So why do car insurance premiums differ by driver? Insurers are mainly trying to estimate two things:

- How likely is it that a claim will happen?

- How expensive could that claim be if it happens?

Those estimates depend on your risk profile (risk-related details about the driver, vehicle, and location) and your coverage choices (deductible level, coverage types, and coverage limits). That’s why the “same car” does not always mean the “same price.”

3. Key Factors That Influence Insurance Costs

Insurance pricing differs by market, but these categories are common worldwide. Together, they shape your risk profile and the expected cost of claims.

Driver factors

Age and driving experience

Newer drivers often have less experience handling hazards, which can increase claim likelihood. That can raise car insurance premiums for some groups.

Driving history (violations and past claims)

Insurers often consider past accidents, serious violations, or frequent claims because they can signal higher future risk. A clean record may support lower insurance cost.

Driving frequency and mileage

More time on the road means more exposure to accidents. Higher mileage, frequent commuting, and regular driving in heavy traffic can raise risk.

Location factors

Where the car is kept and driven

Location may influence theft risk, vandalism risk, accident frequency, and local repair costs. Even within the same region, neighborhood risk can differ.

Weather and environmental risks

Some areas face higher risk of flooding, storms, hail, or other severe weather. If claims are more likely or more costly, premiums may rise.

Vehicle factors

Vehicle value and repair cost

Some vehicles cost more to repair due to parts, technology, or labor. Higher repair costs can increase claim severity and raise car insurance premiums.

Safety and theft characteristics

Safety features may reduce injury severity, and anti-theft features may reduce theft likelihood. Impact varies widely depending on policy design and local risk patterns.

Policy factors

Coverage level and coverage limits

Broader coverage and higher coverage limits often increase premium because they increase potential payout.

Deductible impact

The deductible impact is often significant. Higher deductibles usually lower premium because you agree to pay more out of pocket before the insurer pays.

Vehicle use and drivers listed

Business use, frequent long-distance driving, and adding multiple drivers can change exposure and risk estimates.

Key idea: car insurance premiums are usually the result of many pricing factors combined—not one single factor.

4. Why Insurance Premiums Vary From Person to Person

Two people can own similar cars and still pay different amounts because pricing is based on expected risk and expected claim cost in each situation.

Car insurance premiums commonly vary because of differences in:

- Exposure: mileage, traffic, parking environment

- Behavior signals: record, past claims, violations

- Local costs: repairs, medical costs, and claim patterns

- Coverage structure: deductible impact and coverage limits

- Risk grouping: insurers group similar risk profiles together

This is why “my friend pays less” is not always a useful comparison unless both policies and situations are truly similar.

5. General Cost Ranges Explained Carefully

People often ask about the average cost of car insurance. The safest educational answer is that it varies widely and depends on multiple factors. The same driver can even see different premiums over time if repair costs rise, claim frequency changes, or coverage choices change.

Instead of focusing on exact prices (which can mislead), think in general scenarios:

- Often lower-cost: experienced driver, clean record, lower mileage, safer parking, higher deductible, moderate coverage limits.

- Often higher-cost: new driver, past violations or multiple claims, higher mileage, high-theft area, expensive-to-repair vehicle, lower deductible, higher coverage limits.

Also remember: comparing “average cost” between countries may not be meaningful because laws, repair costs, and typical claim sizes differ greatly.

6. How Deductibles, Limits, and Coverage Choices Affect Total Cost

Many premium surprises come from coverage structure. Two policies can look similar until you compare deductible and limit details.

Deductible impact (what you pay first)

A deductible is what you pay out of pocket before the insurer pays on a covered claim (where a deductible applies). In many cases:

- Higher deductible: often lower premium, but higher out-of-pocket cost when you claim.

- Lower deductible: often higher premium, but lower out-of-pocket cost when you claim.

Practical rule: choose a deductible you can pay without forcing debt or breaking your budget.

Coverage limits (how much the policy can pay)

Coverage limits are the maximum amounts the policy may pay for certain types of losses. Higher limits often raise premium, but they can reduce your worst-case financial exposure in severe incidents.

Coverage choices (what is included)

Coverage choices affect how many situations the policy is designed to help with. Broader coverage can increase premium because it expands what could be paid. Narrow coverage can reduce premium but may leave more risk on you.

Bottom line: total insurance cost is not just the premium. It includes what you might pay later through deductibles and uncovered costs.

7. Common Misconceptions People Have About Insurance Pricing

Misconception 1: “My premium should match my friend’s.”

Different risk profile, location, mileage, and coverage limits can all change the price.

Misconception 2: “Price is based only on the car.”

The vehicle matters, but driver history, location risk, and deductible impact can matter just as much.

Misconception 3: “Cheapest premium is always best.”

Cheaper premium can come with higher deductible, lower coverage limits, or narrower coverage. Price alone does not show protection level.

Misconception 4: “If I pay a premium, every claim must be paid.”

Claims depend on policy rules, exclusions, deductibles, limits, and reporting requirements.

Misconception 5: “No claim means the premium was wasted.”

Insurance is mainly protection against rare but expensive losses. Not needing it can be a good outcome.

8. Practical, Non-Sales Tips for Managing or Reducing Insurance Costs Safely

1) Build a safer driving pattern

Safe driving reduces accidents and violations, supporting a better risk profile over time.

2) Choose a deductible you can handle

A higher deductible can reduce premium, but only if you can pay it comfortably after an accident.

3) Match coverage limits to real risk

Very low coverage limits can leave you exposed in serious incidents. Think of limits as financial protection, not just a price setting.

4) Reduce exposure where possible

Less driving, safer routes, and secure parking can reduce theft or accident exposure.

5) Maintain the vehicle

Maintenance supports safety and reduces preventable incidents. Safer vehicles reduce risk on the road.

6) Read the key policy terms

Know your deductible impact, exclusions, and coverage limits. Clear understanding prevents surprises.

7) Keep policy details accurate

Changes in location, mileage, and drivers can affect pricing factors. Accuracy supports fair pricing and smoother claims.

For general consumer education on money decisions and planning habits, you can also explore:

Consumer Financial Protection Bureau (CFPB)

and

NAIC Consumer Insurance Information.

9. Educational Disclaimer

Educational note: This article is for learning only and is not insurance, legal, or financial advice. Insurance rules, pricing factors, coverage limits, and deductible impact vary by country and policy type. Always read your policy documents for your specific terms.

FAQ

Why do car insurance premiums differ by driver?

Car insurance premiums differ because insurers price risk and expected claim costs. Your risk profile, location, driving history, deductible impact, and coverage limits can all affect the premium.

Does a higher deductible always lower the premium?

Often it can, but it depends on multiple pricing factors. A higher deductible usually shifts more cost to you, which can reduce the premium.

What does “average cost” mean for car insurance?

The average cost is a broad estimate that varies widely by market and driver group. It can give general context, but it may not predict an individual premium.

Do coverage limits affect insurance cost?

Yes. Higher coverage limits usually raise premium because the policy may pay more in severe incidents.

What is the safest way to manage insurance cost?

Focus on safe driving, choose an affordable deductible, and select coverage limits that reduce major financial risk—without cutting protection too far.