Deductible vs Copay vs Coinsurance: Avoid Costly Confusion + 5 Simple Examples

Deductible vs copay vs coinsurance is one of the biggest reasons people feel surprised by healthcare bills. These three terms explain how you and the insurer share costs when you use covered care. And yes—two people can pay similar premiums but have very different total insurance cost because their deductible, copays, and coinsurance work differently.

In this beginner-friendly guide from Insurance & Finance Education (operated by Kehost Team), you’ll learn clear definitions, how the terms work together step-by-step, and how to compare plans safely using pricing factors, coverage limits, and out-of-pocket rules—without quotes, brands, affiliate language, or sales pressure.

1. Simple Introduction Explaining the Topic in Plain Language

Insurance is meant to reduce financial shock. Instead of paying a huge, unexpected bill alone, you pay a smaller, predictable amount (your premium) to keep coverage active. If you use covered healthcare, the insurer may help pay—but usually not 100%.

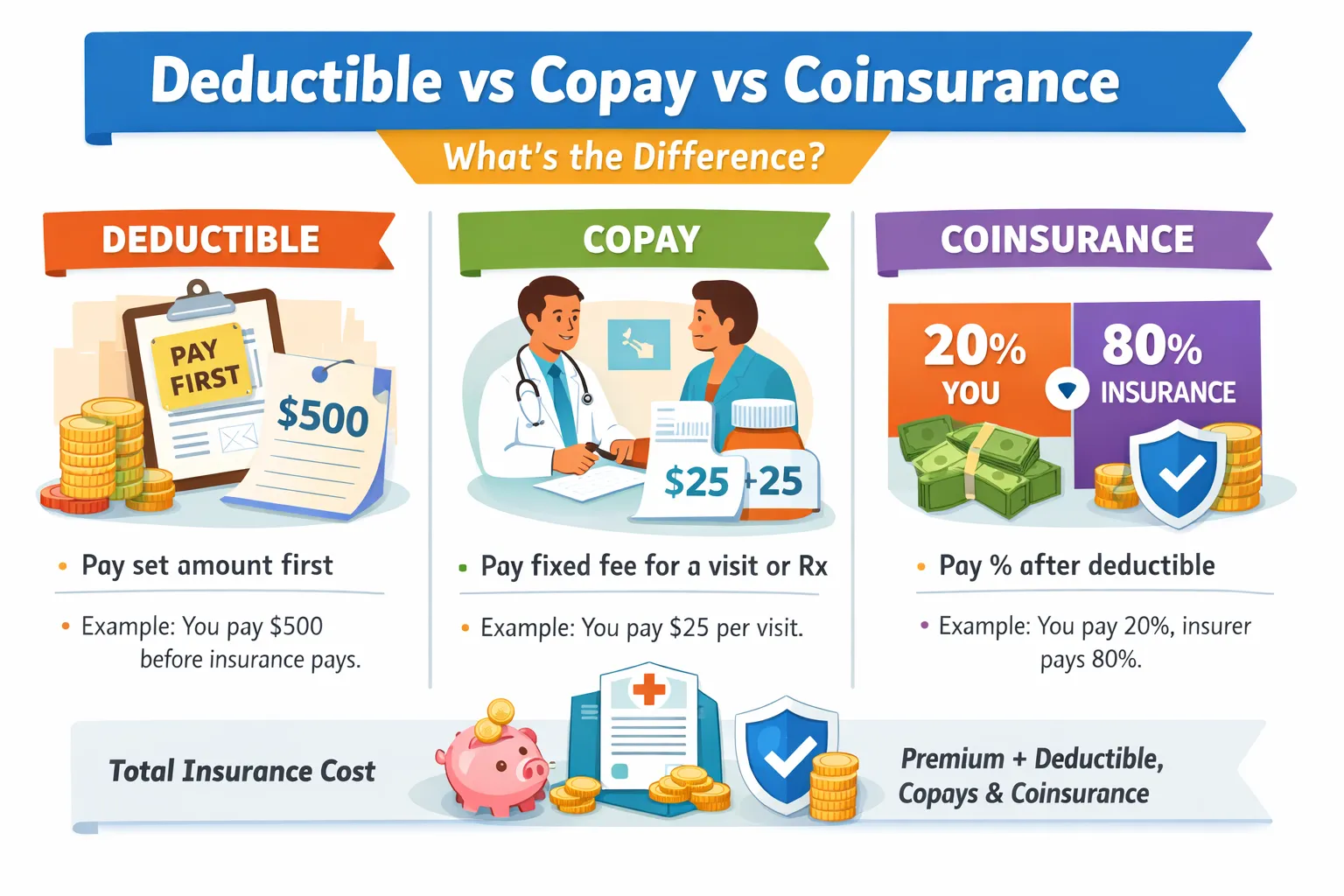

This is where deductible vs copay vs coinsurance matters. These terms describe the “cost-sharing” rules:

- Deductible = what you may pay first before the plan shares many costs.

- Copay = a fixed fee you pay for certain services.

- Coinsurance = a percentage split you pay for covered services (often after the deductible).

If you want the bigger picture of insurance fundamentals first, you can read:

How Insurance Works: Premiums, Risk Pooling & Claims.

2. One-Minute Summary: Deductible vs Copay vs Coinsurance

Here is the simplest way to remember deductible vs copay vs coinsurance:

- Deductible: the amount you pay out of pocket for many covered services before the insurer starts sharing costs (depending on the policy rules).

- Copay (copayment): a fixed amount you pay for a specific covered service (for example, a clinic visit).

- Coinsurance: a percentage of the allowed cost you pay for a covered service (for example, 20%), while the insurer pays the rest (for example, 80%).

Key takeaway: These are three different cost-splitting methods. They can exist together in one policy.

Related internal guide:

Key Insurance Terms Explained (Premium, Deductible, Limit, Exclusion).

Trusted external definitions (optional learning):

HealthCare.gov glossary,

CMS SBC / Uniform Glossary resources,

AHRQ MEPS insurance terms glossary.

3. What Is a Deductible? (And “Deductible Impact”)

A deductible is an amount you pay out of pocket before the insurer starts sharing costs for many covered services—in the parts of the plan where deductibles apply.

Deductible impact means your deductible level strongly shapes your real costs:

- Higher deductible: often lowers premium, but increases what you must pay first when you need care.

- Lower deductible: often raises premium, but reduces what you must pay first.

Important: Some services may be covered before the deductible (policy-dependent). Other services may require you to pay the deductible first. Always check the plan’s benefit rules for each service category.

Simple mental model: The deductible is like a “start line.” Before you cross it, you may pay more. After you cross it, the plan may share more costs (often through coinsurance).

4. What Is a Copay?

A copay (copayment) is a fixed fee you pay for a covered service. Copays are often used for common services such as:

- primary care visits

- specialist visits

- urgent care visits

- prescription medicines

Copays feel predictable because you know the amount in advance. That said, copays can still have rules (for example, different copays for different service types or different medicine tiers).

Practical note: A copay does not always mean “no other costs.” For certain complex services, the policy can still apply other rules (like deductible, coinsurance, limits, or exclusions). This is one reason deductible vs copay vs coinsurance can be confusing until you see the full plan schedule.

5. What Is Coinsurance?

Coinsurance is a percentage of the allowed cost you pay for a covered service (often after the deductible is met in many plan designs).

Example:

- If coinsurance is 20% and the allowed cost is 100, you pay 20.

- The insurer pays the remaining 80% (subject to the plan’s rules).

Coinsurance can feel less predictable than copays because it depends on the price of the service. That’s why coinsurance matters most for expensive care (like imaging, procedures, or hospital services).

Key phrase to understand: many plans apply coinsurance to the allowed amount (the plan’s approved cost), not whatever a provider first bills. How “allowed amounts” work varies by system and policy network rules.

6. How They Work Together in Real Life (Step-by-Step)

Most people try to understand deductible, copay, and coinsurance separately. But in real life, deductible vs copay vs coinsurance often follows a sequence.

Step 1: You pay the premium to keep coverage active

The premium is what you pay regularly (monthly, quarterly, or yearly). Premium is not the same as deductible, copay, or coinsurance.

Step 2: You use healthcare, then the plan applies its cost-sharing rule

Depending on the service, you might pay:

- a copay (fixed fee), or

- the service cost that counts toward the deductible, or

- coinsurance (percentage split), or

- a combination (for example, deductible first, then coinsurance).

Step 3: Once the deductible is met, coinsurance may apply for many services

After you have paid enough out of pocket to meet the deductible, the plan may begin paying more—while you pay coinsurance for covered services (until other caps apply).

Step 4: A spending cap may limit covered out-of-pocket costs (policy-dependent)

Many health plans include an out-of-pocket maximum for covered services. Once you hit it, the plan may cover more of covered costs for the rest of the period. (Rules vary by plan and country.)

Why this matters: The “real” insurance cost is often the premium plus whatever you pay through deductible, copays, and coinsurance over the year.

7. 5 Simple Examples (Clinic, Pharmacy, Labs, Imaging, Surgery)

Important: The numbers below are illustrative examples only to show how deductible vs copay vs coinsurance works. They are not “average cost (general)” and are not tied to any country, provider, or insurer.

Example 1: Routine clinic visit with a copay

Your plan states: “Primary care visit copay = 10.”

- You pay the copay (10) at the visit.

- The plan pays the remaining allowed amount (subject to rules).

What to learn: Copay is fixed and predictable.

Example 2: Prescription medicine with a copay

Your plan uses medicine tiers and states: “Generic medicine copay = 5.”

- You pay 5 when you fill the prescription.

- The plan covers the rest of the allowed cost (subject to rules).

What to learn: Copays often vary by medicine tier.

Example 3: Lab tests that apply to the deductible

Your plan states: “Lab tests apply to deductible.” The allowed lab cost is 60 and you have not met your deductible.

- You pay 60 out of pocket.

- That 60 counts toward your deductible.

What to learn: Some services are “deductible first” before cost-sharing improves.

Example 4: Imaging (like MRI) with coinsurance after deductible

Assume you already met your deductible. The plan says: “Coinsurance = 20% for imaging.” The allowed cost is 500.

- You pay coinsurance = 20% of 500 = 100.

- The plan pays the remaining 400 (subject to rules).

What to learn: Coinsurance can be expensive for high-cost services.

Example 5: Surgery (deductible + coinsurance)

Assume your deductible is 300 and you still have 200 left to meet. The allowed cost for a covered procedure is 2,000 and coinsurance is 20% after the deductible.

- You pay the remaining deductible amount first: 200.

- Then coinsurance applies to the rest: 20% of (2,000 – 200) = 20% of 1,800 = 360.

- Total you pay (illustration) = 200 + 360 = 560 (plus your premiums).

What to learn: “Deductible first, then coinsurance” is where costs can rise quickly.

Mini-summary: Copays are fixed, coinsurance is a percentage, and deductible impact determines how much you pay before the plan shares more costs.

9. Coverage Limits, Exclusions, and Out-of-Pocket Maximums

To compare plans accurately, you must look beyond deductible vs copay vs coinsurance and also check:

Coverage limits

Coverage limits are the maximum amounts a policy may pay for certain services or categories. Limits can be per service, per year, or per lifetime depending on the system and plan design.

Out-of-pocket maximum (spending cap)

Many health-related plans include an out-of-pocket maximum for covered services in a period. Once reached, the plan may cover more (or most) covered costs for the rest of the period—policy-dependent.

Exclusions

Exclusions are services or situations the policy does not cover. A plan can appear cheaper partly because it excludes more categories. That’s why reading exclusions is essential.

Quick warning: A plan can look “affordable” until you notice tight limits or important exclusions. Always compare plans “like for like.”

10. Common Misconceptions

Misconception 1: “Copay and coinsurance are the same.”

No. Copay is a fixed fee. Coinsurance is a percentage split.

Misconception 2: “If I pay a premium, I shouldn’t pay anything else.”

Premium keeps coverage active. Deductible vs copay vs coinsurance describes what you may still pay when you use covered services.

Misconception 3: “Low premium always means lower insurance cost.”

Not necessarily. A low premium can come with a high deductible and coinsurance exposure. Total cost depends on plan structure and how much care you use.

Misconception 4: “Average cost (general) tells me what I’ll pay.”

Average cost is broad. Your spending depends on your plan rules, your usage, and coverage limits and exclusions.

11. Practical, Non-Sales Tips to Manage Costs Safely

1) Compare plans “like for like”

When comparing deductible vs copay vs coinsurance, match the same deductible level, copay schedule, coinsurance percentage, and coverage limits. Otherwise, you’re comparing different protection levels.

2) Choose a deductible you can realistically pay

Deductible impact is powerful. A higher deductible can reduce premium, but only choose it if you could pay it without stress when care is needed.

3) Pay attention to coinsurance for expensive services

Coinsurance matters most for costly care. Even a small percentage can become a large number when services are expensive.

4) Read exclusions and limits before relying on coverage

Exclusions and coverage limits can change what you actually receive. Many “surprise bills” are really “surprise rules.”

5) Keep a small emergency buffer

Even modest savings helps you handle deductibles, copays, and uncovered expenses without high-cost debt.

6) Learn the language once, benefit forever

Understanding deductible vs copay vs coinsurance once makes it easier to understand any policy document in the future.

FAQ

What is the difference between deductible vs copay vs coinsurance?

Deductible is what you may pay first for many services before the plan shares more. Copay is a fixed fee for specific services. Coinsurance is a percentage you pay for covered care (often after meeting the deductible).

Do I pay a copay before meeting my deductible?

It depends on the plan. Some plans charge copays even before the deductible is met, while other services require deductible payment first. Always check the plan rules for each service category.

Is coinsurance always paid after the deductible?

Often, but not always. Many plans apply coinsurance after the deductible for certain services, but policy designs vary.

Does a higher deductible usually mean a lower premium?

Often yes, because you accept more out-of-pocket risk first. But premium pricing depends on many pricing factors, regulation, and plan design.

How can I estimate my “real” insurance cost?

Look at premium + expected usage. Then check deductible impact, copays, coinsurance, coverage limits, exclusions, and any out-of-pocket maximum rules.

Educational Disclaimer

Educational disclaimer: This content is for general education only and is not insurance, legal, medical, or financial advice. Rules for premiums, deductibles, copays, coinsurance, coverage limits, exclusions, networks, and claims vary by country, provider, and policy type. Always read your policy documents for your specific terms.