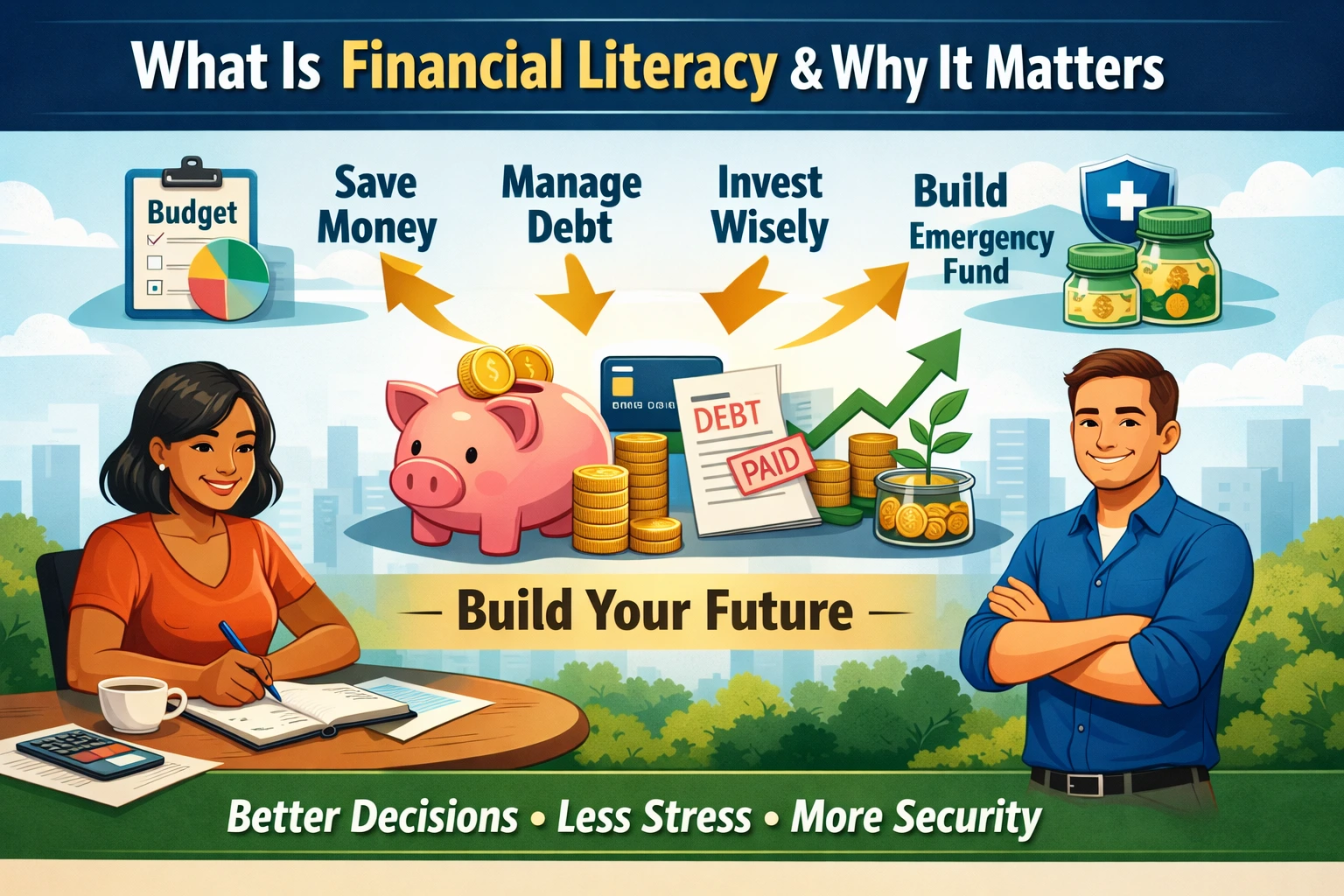

What Is Financial Literacy and Why It Matters (Beginner Guide)

Financial literacy means understanding money and using basic skills—budgeting, saving, debt control, and smart planning—to make better choices in daily life.

In this guide, you’ll learn what it is, why it matters, the key skills to build, and a simple plan you can follow to improve your money habits step by step.

1. What Is Financial Literacy? (Simple Definition)

Financial literacy in one sentence: it’s knowing how money works and using that knowledge to make better decisions.

You don’t need to be a finance expert. You simply need to handle everyday questions like:

- Where does my money go each month?

- How do I budget without suffering?

- How do I save even if income is small?

- How do interest and fees affect loans?

- How do I prepare for emergencies?

- How do I start investing safely for long-term goals?

If you want a practical starting point, read:

Personal Finance Basics: A Beginner’s Roadmap.

2. Why It Matters (Real-Life Reasons)

Financial literacy matters because life is expensive and unpredictable. Without a plan, people spend by default, borrow under pressure, and feel stressed often.

It helps you:

- Reduce money stress: you know what you can afford before you spend.

- Avoid debt traps: you understand interest, fees, and repayment pressure.

- Build savings: even small savings reduces emergency borrowing.

- Make smarter choices: you compare options and read terms before paying.

- Protect your progress: one emergency doesn’t destroy your plan.

- Grow over time: consistent saving and investing can build wealth slowly.

Simple truth: You don’t need a high income to make smart money decisions. But without money skills, even a high income can disappear fast.

3. The 6 Core Money Skills

Think of this topic as a set of skills. When you improve these skills, money becomes easier to manage.

1) Cash flow (income vs expenses)

Know what comes in and what goes out. If you don’t track spending, everything becomes guesswork.

2) Budgeting

A budget is a plan for your money before you spend it. A good budget is simple and realistic—not perfect.

3) Saving (especially an emergency fund)

Savings protects you from borrowing when problems happen. Your emergency fund acts like a shock absorber.

4) Debt and credit

Understand interest rates, fees, and loan terms. High-interest debt is usually the most dangerous because it grows quickly.

5) Investing and long-term planning

Investing is how money can grow over years. Learn risk, time, diversification, and why “quick profit” promises are often scams.

6) Protection (risk management)

One accident can wipe out savings. That’s why people use emergency funds and insurance for major risks.

For a simple protection explanation, read:

How Insurance Works: Premiums, Risk Pooling & Claims.

4. Signs You Need Stronger Money Skills

Most people were never taught money habits in school. Use this checklist:

- You don’t know your real monthly spending (you only guess).

- You often run out of money before payday.

- You use debt for basic needs repeatedly.

- You don’t have emergency savings.

- You buy things quickly and regret them later.

- You feel confused reading interest rates or fees.

- You chase “fast money” opportunities without checking risk.

Good news: these are learnable skills. You can improve with practice.

5. How to Improve (Simple Steps)

Here’s a simple way to build better money habits without feeling overwhelmed.

Step 1: Track spending for 7 days

Write every expense (even small ones). This gives you the truth about your habits.

Step 2: Create a beginner budget

Use a simple method like needs, goals, and wants. The goal is control, not perfection.

Step 3: Start a small emergency fund

Start small: one week of essential expenses is a good first target. Build gradually.

Step 4: Attack high-interest debt

Pay minimums on all debts, then focus extra money on one target debt until it’s cleared.

Step 5: Learn one topic per week

Budgeting, saving, debt, investing, protection—one per week is enough.

Helpful budgeting resource:

CFPB budgeting tools (free)

6. Weekly Habits That Make You Better With Money

Small routines work better than motivation.

Try this weekly routine (15 minutes)

- Check your balance: know what you have today.

- Review spending: where did money go this week?

- Adjust the plan: fix next week before it starts.

- Save something: even a small amount builds consistency.

- Learn one concept: interest, fees, loans, investing basics, etc.

7. Common Mistakes (And How to Avoid Them)

Mistake 1: No plan, only spending

Fix: Make a simple budget and check it weekly.

Mistake 2: Confusing wants with needs

Fix: Pay needs first, then plan a small amount for wants.

Mistake 3: Ignoring high-interest debt

Fix: Focus on the highest-interest debt first or the one stressing you most.

Mistake 4: No emergency fund

Fix: Start small and build gradually.

Mistake 5: Believing “quick money” promises

Fix: If it sounds too good to be true, it usually is. Learn the basics first.

8. Trusted Resources

Reminder: Part of being smart with money is learning to verify sources—especially online.

FAQ

What is financial literacy in simple words?

Financial literacy means understanding money and using that knowledge to budget, save, manage debt, and make better decisions.

Why is financial literacy important?

It helps you avoid debt traps, build savings, prepare for emergencies, and reach long-term goals with less stress.

How can I improve fast?

Track spending for a week, make a simple budget, start emergency savings, reduce high-interest debt, and learn one money topic per week.

Is this only for rich people?

No. These skills help anyone manage any income level better.