Why Insurance Quotes Vary: 7 Crucial Factors to Avoid Costly Surprises

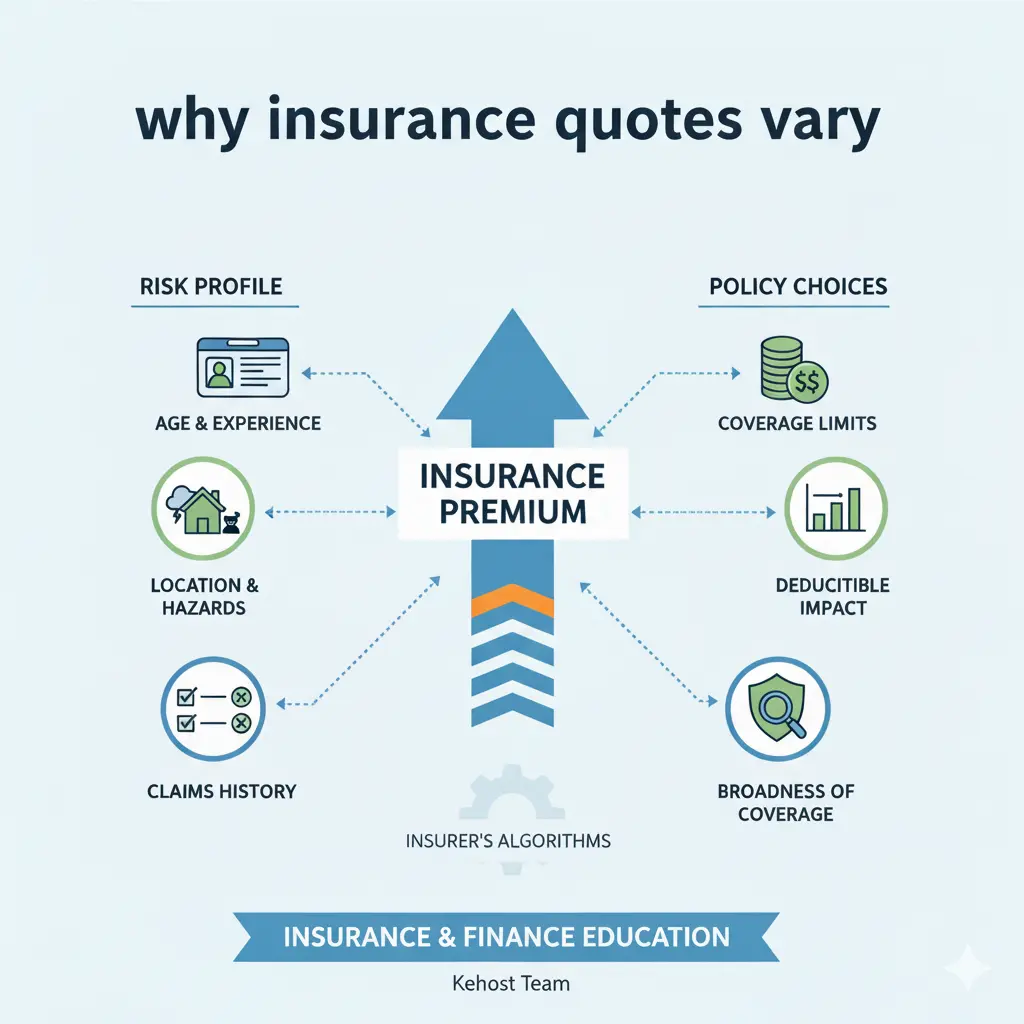

When you start looking for protection, one of the first things you notice is that prices are rarely the same across different providers. Many beginners find it frustrating to realize that why insurance quotes vary so much is often due to hidden variables they haven’t considered. Whether you are comparing auto, home, or health coverage, understanding the insurance cost structure is vital to making an informed decision.

In this educational guide from Insurance & Finance Education (operated by Kehost Team), we will explain the mechanics of pricing. You will learn why insurance quotes vary between individuals, how insurers calculate a risk profile, and how choices like coverage limits and deductible impact shape your final bill—all without sales pressure or brand-specific recommendations.

A simple introduction explaining why insurance quotes vary

At its core, insurance is a financial safety net. To keep this net in place, you pay a regular fee. However, because no two people or situations are exactly alike, the price changes based on the level of “risk” the insurer is taking on. One of the main reasons why insurance quotes vary is the specific environment and history of the person applying for the policy.

Imagine two people living in different parts of a city. One lives in an area prone to flooding, while the other lives on a high hill. Even if they have identical houses, the person on the hill faces less risk of water damage. Consequently, the cost to protect their homes will differ. This variation is a primary example of why insurance quotes vary based on external hazards and mathematical probability.

Key factors that influence insurance costs

Insurers use a wide variety of pricing factors to determine how much to charge. These inputs help build your unique risk profile.

1. Age and Experience

Statistical data often shows that certain age groups are more prone to specific risks. For example, very young drivers may have higher rates for auto insurance due to a lack of experience. Age acts as a proxy for biological risk and behavioral patterns, which is a significant factor in why insurance quotes vary.

2. Geography and Local Hazards

Where you live is one of the most significant pricing factors. A home located near a coastline might be more expensive to insure against wind damage than a home inland. Local crime rates, weather patterns, and even the distance to the nearest fire station all play a role in why insurance quotes vary from one zip code to the next.

3. History of Claims

Your history tells a story. If you have a long record of safe behavior, you are seen as lower risk. Conversely, a history of frequent claims suggests a higher probability of future costs, leading to an increased insurance cost.

Why insurance premiums vary from person to person

Even if two people look similar on paper, their quotes can be miles apart. This happens because every insurance provider uses its own proprietary mathematical formula to assess risk. One company might put a heavy emphasis on your credit-based insurance score, while another might focus more on your geographic location.

Furthermore, lifestyle choices—such as whether you smoke, how many miles you drive per year, or whether you have a home security system—create a unique data set. This data-driven approach is the ultimate reason why insurance quotes vary; the insurer is trying to predict the future based on your specific past and present habits.

General cost ranges explained carefully

It is common to search for the “average cost (general)” of insurance, but these numbers can be misleading. Because insurance is a global industry, an “average” price in one region might be considered “expensive” elsewhere. Instead of looking for a fixed number, it is more helpful to understand that costs vary widely and depend on multiple factors.

Generally, lower costs are found in low-risk profiles with high deductibles. Higher costs are found in high-hazard locations with low deductibles. Because the risk profile is dynamic, your quote will always be a personalized price tag rather than a fixed market rate.

How deductibles, limits, and coverage choices affect total cost

When you customize a policy, you change the insurance cost. Two of the most important factors are the deductible and the policy limit.

The Deductible Impact

A deductible is the amount you pay out-of-pocket before the insurer pays. A high deductible typically leads to a lower premium because you are taking on more of the initial risk. For a deeper look at how these costs are shared, see our guide on Deductible vs Copay vs Coinsurance.

Policy Coverage Limits

The coverage limits represent the maximum amount the insurance company will pay for a covered loss. Choosing higher limits provides more protection but increases the insurance cost. You can learn more about how to choose the right maximum payout in our article on Policy Limits Explained.

For a high-level overview of these technical terms, you can also refer to the Investopedia definition of Insurance Premiums or the Insurance Terms and Definitions PDF from CPUT.

Common misconceptions people have about insurance pricing

There are several myths that lead to confusion regarding why insurance quotes vary:

- “Color affects auto insurance:” Red cars do not cost more to insure. The make, model, and safety features matter far more.

- “Full coverage means no out-of-pocket costs:” There are always coverage limits and deductibles to consider.

- “Loyalty guarantees the lowest price:” Rates change based on market data, and your risk profile may fit a different insurer’s formula better over time.

Practical, non-sales tips for managing insurance costs safely

- Audit your coverage limits: Ensure your maximum payouts match your current asset values.

- Improve safety: Installing security systems can positively influence your risk profile.

- Understand the deductible impact: Only choose a high deductible if you have the savings to cover it in an emergency.

- Maintain your credit: In many countries, a stable credit history is linked to lower insurance premiums.

Educational disclaimer

Disclaimer: This article is for general educational purposes only. It does not constitute financial, legal, or professional insurance advice. Insurance regulations and pricing factors vary significantly by country. Always consult with a qualified professional before making financial decisions.